Flames and smoke rise from oil wells set ablaze by Islamic State militants before they fled the oil-producing region of Qayyara, Iraq, 2016. Alaa Al-Marjani/Reuters

Since the 1970s, the Middle East has been the location of a third of all recorded wars between states, nearly 40 percent of all internationalized civil wars and seven out of ten wars of occupation. With the launching of America’s global war on terrorism, a third of all new armed conflicts have emerged in the Middle East since 2000; that number has grown to half since 2010. The Middle East’s share of all terrorism related events worldwide, as defined by the Global Terrorism Database, has likewise increased from 10 percent in the 1970s to over half since 2010.

In effect, the essential relationship of dependency between the United States and the Middle East has never been “oil for security.” It has in fact been oil for insecurity, a dynamic in which war, militarization and autocracy in the region have been entangled with the economic dominance of North Atlantic oil companies, US hegemony and discourses of energy security.

The appeal of energy security discourse is reflected in the writings of both critics and champions of these policies. Critics view the pursuit of energy security claims as a cynical—if not conspiratorial—effort to control the Middle East at the behest of a powerful industry. Advocates tend to view America’s quixotic pursuit of energy security as a tragic case of good intentions gone awry. Oil-for-security narratives nonetheless draw upon powerful Orientalist notions of an inherently vulnerable, violent and backward Middle East. Elite echelons of the US policy establishment can now breathlessly declare, “The Middle East isn’t worth it anymore,” as Martin Indyk did in January.[1] In reality, the administrations of President Barack Obama and President Donald Trump had already reached this conclusion. Haunted by the 2003–2011 Iraq war and propelled by illusions of growing American energy independence, they have both attempted to retread the Nixon Doctrine by outsourcing, as much as possible, the securitization of the region to partners like Morocco, Tunisia, Egypt, Israel, Jordan, Saudi Arabia, the United Arab Emirates (UAE) and Pakistan—policies that have only further deepened the region’s instability.

The late sociologist Charles Tilly once observed that the Western European nation-state is basically a protection racketeering scheme: modern governments offer citizens security from the very insecurities that the governments create.[2] How America’s ill-fated pursuit of energy security in the Middle East came to fit this model first requires a basic understanding of the economic and political means by which profit and power can be, and have been, derived from oil’s natural abundance. When the profits of the major North Atlantic oil companies and the power of American hegemony came under serious assault in the early 1970s, both became increasingly invested in promoting energy security as a centerpiece of US foreign policy. They did so through networks of think tanks and academic institutions led by policy experts who floated seamlessly between oil companies, public service and industry-funded research institutions.

By posing as the protector of the global economy’s most essential energy resource, the United States was able to extract geopolitical power from Middle Eastern oil. Growing insecurity in the Middle East, in turn, has allowed the North Atlantic oil industries to derive economic power from this politically manufactured scarcity. Beyond dramatic episodes of direct military intervention by the United States, the backbone of these security policies is the region’s hyper-militarization, efforts to exacerbate conflicts (often by preventing peaceful resolution) and support for neoliberal authoritarians, all of which have only made the region less secure. Although the destabilizing contradictions of this dependency have now undercut both American hegemony and the power of the North Atlantic hydrocarbon industries, the oil-for-insecurity entanglement has nonetheless created dangerously strong incentives for more conflict ahead.

The Logic of Oil for Insecurity

Oil’s violent geopolitics is often assumed to result from the immense power its natural scarcity affords to those who can control it. Recent developments in global hydrocarbon markets, which saw negative prices on April 20, 2020 have once again put this scarcity myth to bed. Hydrocarbons are likely the second most plentiful liquid on the planet after water. When commodities like oil (and drugs) are lucrative, strategic and abundant, extracting profits and power from them often requires tacit or explicit public-private partnerships to make them appear less prevalent or accessible than they could be under different circumstances. The contest to control abundance by manufacturing scarcity most often occurs at the dominant sites of extraction and circulation. Above all, the Middle East holds the world’s most significant concentrations of easily accessible high-quality hydrocarbon reserves.

In the context of North Atlantic capitalism, the scarcity of hydrocarbons during the first half of the twentieth century was carefully managed by a cartel of major oil firms known as the Seven Sisters, of which four still persist (British Petroleum, Chevron, ExxonMobil and Shell). Their efforts to control oil were gradually contested politically in the age of decolonization after World War II. The Latin American, Asian and African countries being exploited by the cartel’s system, including Saudi Arabia, effectively leveraged threats and acts of nationalization to win new profit-sharing agreements, if not control over their own reserves and production infrastructures. The infamous Anglo-American effort to reverse Iran’s nationalization of its oil industry by organizing a coup in 1953 is suggestive of the high stakes involved.

When the revolt of the producer states reached the Middle East in full force in the early 1970s, North Atlantic capitalism and American hegemony were in the grips of a deepening crisis. As North Atlantic military supremacy repeatedly failed to prevail in places like Korea, Kenya, Algeria and finally Vietnam, the economic boom of the 1950s and 1960s ground to a halt. The major oil and arms companies were also struggling to adapt to a world in which their high rates of profitability were no longer guaranteed.

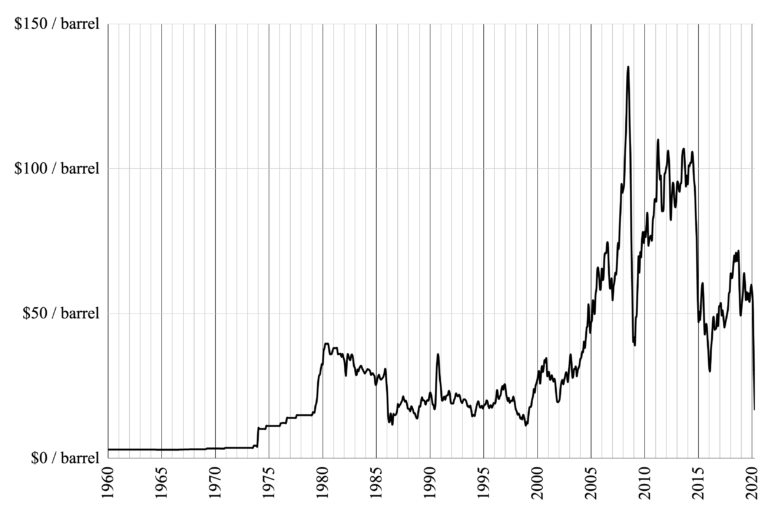

The relationship between war in the Middle East and return on equity in the capitalist oil sector emerged in the context of several key events: the 1967 and 1973 Arab-Israeli wars, the so-called Arab oil embargos and the eight-year blockade imposed on the Suez Canal by Egypt (1967–75). The interregnum between the two Arab-Israeli wars also saw aggressive acts of oil nationalization in Algeria, Libya and Iraq. An even more pronounced period of dominant profitability for the oil companies began in the late 1970s, coinciding with the Iranian revolution, the Soviet invasion of Afghanistan and the seizure of the Grand Mosque in Mecca, all in 1979. This period of high leading profitability would be sustained into the early 1980s with the outbreak of the Iran-Iraq war, Israel’s intervention in the ongoing Lebanese civil war, Libya’s invasion of Chad and countless other conflicts in the region. When oil prices began to collapse in the mid-1980s, the major oil companies witnessed a 14-year downturn that was only briefly interrupted once, during the 1990-1991 Gulf War.

Figure 1: Inflation Adjusted Price of Oil (WTI) since 1960 (Source: US Federal Reserve Bank of St. Louis)

In fact, the late 1980s downturn bears a striking resemblance to today’s developments in the oil market. Given the steep rise in oil prices in the 1970s and the experience of the oil embargoes, new technologies of exploration and exploitation—backed by experts and political leaders calling for energy independence—created new frontiers for oil extraction in places like Alaska, the North Sea and Siberia. All of this new oil supply began flooding the world economy in the early 1980s, coinciding with the rising dominance of futures markets in the pricing of oil. In the face of this oncoming glut, the divisions within the Organization of the Petroleum Exporting Countries (OPEC) undermined what little capacity it had to confront this new reality. According to some disputed accounts, Ronald Reagan’s administration encouraged the Saudis to let prices tumble in the mid-1980s so as to target the Soviet economy’s newfound dependence on oil exports. The damage, however, was not limited to the already collapsing Soviet Union. In order to survive the 1990s, the North Atlantic oil industry witnessed a significant downturn and consolidation amid depressed profitability. British Petroleum merged with Amoco in 1998, Mobil joined with Exxon in 1999 and Chevron bought Texaco in 2000.

Fracking also produced a new reality in which the relationship between widespread war in the Middle East and high oil prices no longer held. In September 2019, the same month that the United States reported net oil exports for the first time since the 1970s, it was also reported that Exxon no longer ranked among the top ten companies on the S&P 500 stock index for the first time ever. Five months later, celebrity financial commentator Jim Cramer described stocks in major oil companies as being in their “death knell phase.” As the former Saudi Minister of Oil Ahmed Zaki Yamani was fond of saying, “The stone age didn’t end because they ran out of stones.”

The Middle East (In)security Lobby

Paradoxically, the notion of American energy security—and its corollary, energy independence—is where strategic and corporate interests that have contributed to an increasingly insecure Middle East converge. Discourses of energy security and independence are driven by fears of natural scarcity, supply disruptions or both. Though these ideas have a deeper intellectual genealogy, the contemporary American obsession with energy security arguably crystalized in the Carter Doctrine in 1980. Prior to the alleged weaponization of oil by several Arab exporting states in 1967 and 1973, the idea of energy security was uncommon. The pages of The New York Times only used the phrase once before 1970; since then, it appeared over 100 times in the 1970s and nearly 650 times since 2000.

In response to the Soviet invasion of Afghanistan and the Iran hostage crisis, the Carter Doctrine declared America’s intent to use military force to protect its interests in the Gulf. In so doing, Carter not only denounced “the overwhelming dependence of the Western democracies on oil supplies from the Middle East,” but he also proposed new efforts to restrict oil imports, to impose price controls and to incentivize more fossil fuel extraction in the United States, all in conjunction with solidifying key alliances (Egypt, Israel and Pakistan) and reinforcing the US military presence in the region.[5] In effect, America would now extract geopolitical power from the Middle East by seeking to secure it.

Driving the policy of energy security has been an “oil scarcity ideology,” as economist Roger Stern calls it.[6] Even if oil is not naturally scarce, this ideology nonetheless holds that the United States is politically and economically vulnerable due to the fact that the largest oil reserves in the world are located in an inherently weak and unstable region. A recent collection of essays by a handful of international relations scholars, Crude Strategy: Rethinking the US Military Commitment to Defend Persian Gulf Oil, takes it as a given that protecting domestic and global energy security from supply disruptions has been the primary reason for the increasing American military presence in the region for the last 50 years.

Even more recently, two experts from the American Enterprise Institute, Hal Brands and Kenneth Pollack, along with Steven Cook of the Council on Foreign Relations, accused the Trump administration of having caused “irreparable damage to the Middle East” and “world order” by abandoning the Carter Doctrine—“a foundation of US foreign policy.” Their imperial pearl-clutching j’accuse suggests Trump’s failure to confront Iran in coordination with our Gulf Cooperation Council “allies” is tantamount to abandoning America’s 75-year bipartisan commitment to “protecting Gulf oil exports” as “a critical component of the international order the United States built after 1945—an order that has made America stronger, more secure, and more prosperous than it otherwise would have been.”[7]

At the same time, energy security discourse can be easily deployed to make the opposite argument by opponents of America’s dependency on foreign fossil fuels, or even fossil fuels per se. The Energy Security Leadership Council, a bipartisan lobbying organization composed of “America’s most prominent business and military leaders,” issued a report in 2018 denouncing the alleged fact that a sixth of the base Pentagon budget goes to “defending global oil supplies.”[8]

The oil industry is also a major patron of the US foreign policy establishment’s premier think tanks. A 2015 report by the Public Accountability Initiative highlights the extent to which the leading liberal and conservative foreign policy think tanks in Washington—the American Enterprise Institute, Atlantic Council, Brookings, Cato, Center for Strategic and International Studies (CSIS), Council on Foreign Relations and Heritage Foundation—have all received oil industry funding, wrote reports sympathetic to industry interests or usually both. Major donors to these think tanks include ExxonMobil, Chevron, David Koch and the CEO of the private equity firm the Carlyle Group. The industry’s go-to experts include self-described energy consultant David Goldwyn (CSIS, Brookings, the Atlantic Council and the National Petroleum Council), who was also a US State Department special envoy for energy affairs under former Secretary of State Hillary Clinton and chair of the 2007 Council on Foreign Relations task force on National Security Consequences of US Oil Dependency; Charles Ebinger (Brookings, the Atlantic Council and National Petroleum Council); and consultant Daniel Yergin (Brookings and Council on Foreign Relations), author of a widely read history of the oil industry, The Prize.[11]

Prominent American academic institutions are equally caught up in these webs of knowledge and power. When President Obama lifted the Carter administration’s 1977 oil export ban in 2015 (mere days after the Paris Climate agreement), the Secretary of Energy was MIT professor Ernest Moniz, a member of the Council on Foreign Relations and Clinton administration official. Moniz is also a founding board member of the King Abdullah Petroleum Studies and Research Center (KAPSARC), a Saudi think tank whose current president, Adam Sieminski, previously served in the US National Security Council, the US Energy Administration Agency and as CSIS’s James R. Schlesinger Chair for Energy and Geopolitics. The current KAPSARC board includes the president of Boston University, Robert Brown, and Daniel Yergin.

Prior to his appointment, Moniz’s industry funded think tank, the MIT Energy Initiative, published an influential report in 2011 that touted the virtues of domestically produced natural gas as a pillar of American energy security in the face of “the uncertain political future in the Middle East.”[12] The report was later positively cited by the Shale Gas Production subcommittee of the Secretary of Energy’s Advisory Board, a body composed of academics, consultants, former government officials and ex-lobbyists with deep ties to the oil industry, including ex-CIA director and MIT professor John Deutch, leading petroleum engineer Stephen Holditch of Texas A&M, natural gas geophysicist Mark Zoback of Stanford and, of course, Daniel Yergin.[13]

How Energy Security Became Insecurity in the Middle East

For some 50 years, the United States has been able to extract geopolitical power from Middle Eastern oil by posing as the protector of global energy security. The invention of the concept of energy security in the 1970s helped to legitimate the efforts of the Nixon, Ford and Carter administrations to forge new foundations for American hegemony amid the political, economic and social crises of that decade. In the wake of the disastrous US war efforts in Korea and Southeast Asia, Henry Kissinger infamously attempted to re-forge American hegemony by outsourcing US security to proxies like Iran under what is referred to as the Nixon Doctrine. At the same time, regional hegemons would be kept in check by “balancing” competing states against each other.

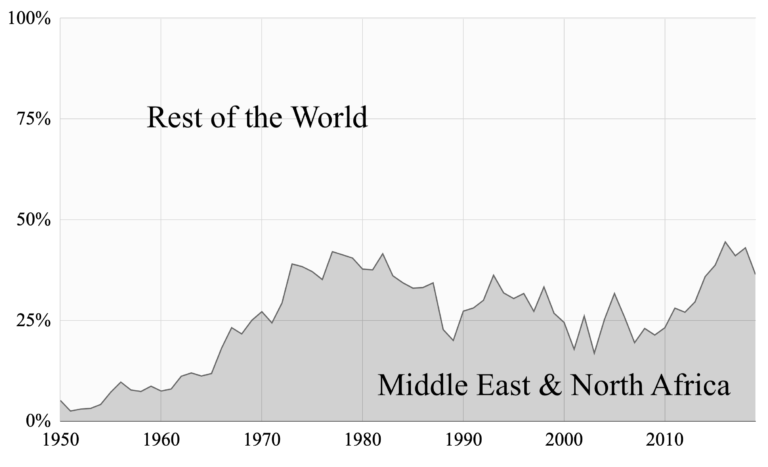

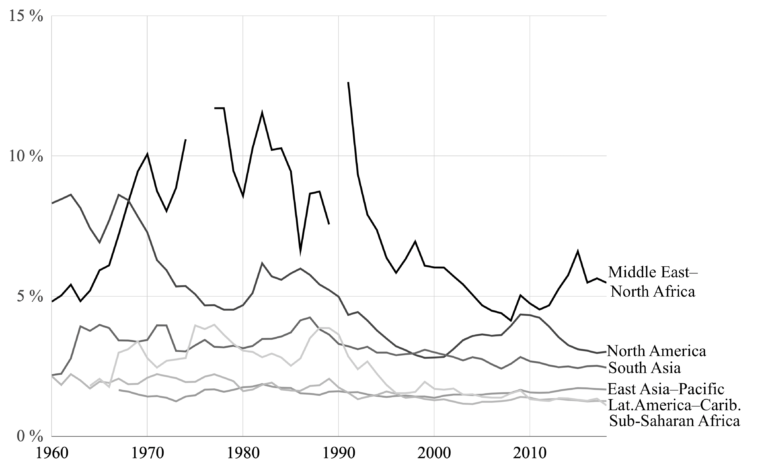

The realization of Middle Eastern insecurity was also made possible by the rapid and intensive arms build-up across the region in the 1970s. As oil prices skyrocketed into the 1980s, billions of so-called petrodollars went to purchase arms, primarily from North Atlantic and Soviet manufacturers. Today, the Middle East remains one of the most militarized regions in the world. Beyond the dominance of the security sector in most Middle Eastern governments, it also boasts the world’s highest rates of military spending. Since 2010, Middle Eastern arms imports have gone from almost a quarter of the world’s share to nearly half in 2016, mainly from North Atlantic armorers.

Figure 2a: Middle East and North Africa Share of Worldwide Arms Imports, 1950–2019

Figure 2b: Military Expenditures per GDP by Region, 1960–2018

(Sources: Stockholm International Peace Research Institute and World Bank.)

For half a century, American policy toward the Middle East has effectively reinforced these dynamics of insecurity by promoting conflict and authoritarianism, often in the name of energy security. High profile US military interventions—Lebanon in 1983, Libya in 1986 and 2011, the Tanker Wars in the late 1980s, the wars on Iraq in 1991 and 2003, Somalia in 1993, Afghanistan since 2001, the anti-Islamic State campaign since 2014 and the Saudi-Emirati war on Yemen since 2015—have received the most scrutiny in this respect, alongside the post-2001 “low intensity” counterterrorism efforts worldwide. The most well-known cases where US policy exacerbated conflicts in the region indirectly are Afghanistan and the Iran-Iraq war in the 1980s, followed by the Syrian insurgency and the Saudi-Emirati war in Yemen. Conversely, cases abound where American policy had the effect of preventing conflicts from being resolved peacefully: Trump’s shredding of the 2015 Joint Comprehensive Plan of Action (JCPOA) nuclear agreement with Iran comes to mind; the case of the Israeli-occupied Palestinian territories and the Moroccan-occupied Western Sahara have likewise become quintessential “peace processes” that have largely functioned to prevent peace.

America’s pursuit of global energy security has equally rested on the myth of authoritarian stability. When this myth finally imploded in the uprisings of 2011, it exposed not only mass political disenfranchisement within two key allied states, Tunisia and Egypt, but also deep levels of socio-economic insecurity across the region. A longstanding US partner in the effort to promote stability through authoritarianism has been the International Monetary Fund (IMF), from the Third World debt crisis and “bread riots” of the 1970s and 1980s to the neoliberal transformation of political economies across the region in the 1990s and 2000s. A year after the unexpected 2011 uprisings, the IMF’s former director Christine Lagarde admitted that the Fund had basically ignored “how the fruits of economic growth were being shared” in the region.[14]

Even those regimes viewed as antagonistic to American interests—notably Libya, Sudan, Syria, Iraq and Iran—have in certain ways benefitted from North Atlantic efforts to contain them through direct and indirect military intervention, unilateral and multilateral sanctions, the US dominated international banking system and the continuing centrality of the dollar in the global economy. In denouncing certain governments as “pariahs” or “rogue states,” and in calling for regime change, American policy has allowed those leaders to institute permanent states of emergency that have reinforced their grip on power, in some cases aided by expanded oil rents due to heightened global prices. At the same time, Saudi Arabia is not the only country that has used oil abundance as a geopolitical tool. The United States’ newfound energy independence of the past decade has allowed Washington to impose punishing sanctions on hydrocarbon exporting countries like Iran, Russia and Venezuela—and to shrug at the collapse of the Libyan state—without fears of driving up oil prices worldwide and hurting US consumers.

The End of Oil for Insecurity?

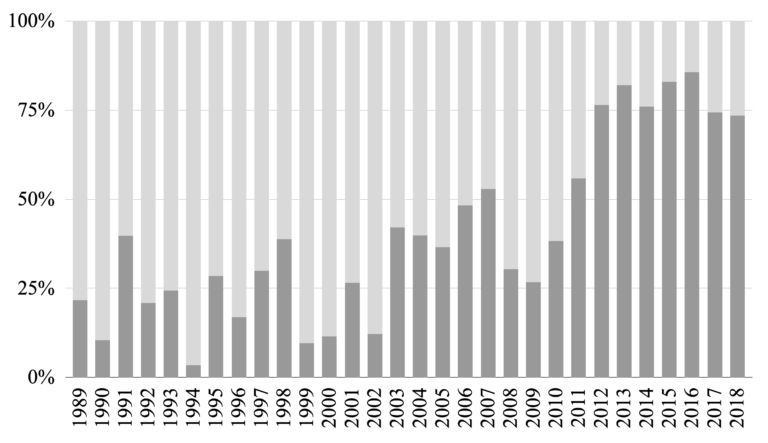

From 2012 to 2018, organized violence in the Middle East accounted for two-thirds of the world’s total conflict related fatalities. Today, three wars in the region—Syria, Iraq and Afghanistan—now rank among the five deadliest since the end of the Cold War. Excluding Pakistan, the Middle East’s share of the worldwide refugee burden as of 2017 was nearly 40 percent at over 27 million, almost double what it was two decades prior.

Figure 3: Middle East and North Africa Share of Fatalities from Armed Conflict and One-sided Violence, 1989–2018

(Source: Upsala Conflict Data Program)

This period of extraordinary insecurity also witnessed an extraordinary decoupling of the previous relationship between the profitability of the major North Atlantic oil companies and mass violence in the Middle East. For the first time since the late 1960s, the industry’s relative profitability declined to unprecedented lows even as civil wars proliferated and foreign military interventions multiplied across the Middle East. The main reason for this decoupling was the explosion in oil production in the United States. The boom in extraction had been legitimated by an industry-funded discourse of energy security that itself had been both a cause and consequence of the war in Iraq in the first decade of the 2000s.

Although the United States is no longer the only country able to extract profit and power by promoting Middle Eastern insecurity (note Turkish and Russian interventions in the Syrian and Libyan civil wars), it is nonetheless the responsibility of the American public to hold our leaders accountable for decades of these policies and to demand democratic ownership of a public good as basic and essential as our energy systems. While nationalizing the North Atlantic’s petroleum industries is not only an imperative in the fight against climate change, it would also remove much of the profit motive from making war in the Middle East. Nationalizing the oil industry would also help to defund those institutions most responsible for both disseminating the myths of energy security and promoting insecurity in the Middle East.

[Jacob Mundy is an associate professor at Colgate University and a member of MERIP’s editorial committee.]

Endnotes

[1] Martin Indyk, “The Middle East Isn’t Worth It Anymore,” Wall Street Journal, January 17, 2020.

[2] Charles Tilly, “War Making and State Making as Organized Crime,” in Peter Evans, Dietrich Rueschemeyer and Theda Skocpol, eds. Bringing the State Back (Cambridge: Cambridge University Press, 1985).

[3] Shimshon Bichler and Jonathan Nitzan, “Arms and Oil in the Middle East: A Biography of Research,” Rethinking Marxism 30/3 (2018).

[4] Mazen Labban, “Oil Spill: Inside the Global Market for Crude,” The American Prospect, April 28, 2020.

[5] President Jimmy Carter, “Address by President Carter on the State of the Union Before a Joint Session of Congress, January 23, 1980,” Foreign Relations of the United States, 1977–1980. [https://history.state.gov/historicaldocuments/frus1977-80v01/d138]

[6] Roger Stern, “Oil Scarcity Ideology in US Foreign Policy, 1908–97,” Security Studies 25/2 (2016).

[7] Hal Brands, Steven A. Cook and Kenneth M. Pollack, “RIP the Carter Doctrine, 1980-2019,” Foreign Policy, December 13, 2019.

[8] Securing America’s Future Energy (SAFE), “The Military Cost of Defending Global Oil Supplies,” September 21, 2018.

[9] See the articles by Shana Marshall and Pete Moore in this issue of Middle East Report 294 (Spring 2020).

[10] Center for Responsive Politics, “Influence and Lobbying: Oil & Gas,” OpenSecrets.org, accessed May 11, 2020.

[11] Kevin Connor, Robert Galbraith and Aaron Cantu, “The Oil Tanks,” Public Accountability Initiative, December 4, 2015.

[12] Ernest Moniz et al., “The Future of Natural Gas: An Interdisciplinary MIT Study,” 2011, p. 153. [http://energy.mit.edu/wp-content/uploads/2011/06/MITEI-The-Future-of-Natural-Gas.pdf]

[13] Jie Jenny Zou, “How Washington Unleashed Fossil-Fuel Exports and Sold Out on Climate,” The Center for Public Integrity, October 16, 2018.

[14] Christine Lagarde, “The Arab Spring, One Year On,” IMF Blog, December 6, 2011.